Canara Bank In 2026, many investors are shifting their focus toward safer and shorter investment avenues. With market movements remaining uncertain and interest rates adjusting periodically, fixed deposits have once again become a preferred choice for conservative savers. One deposit plan that is drawing attention is the 310 Day Fixed Deposit offered by Canara Bank. Designed for short term parking of funds, this special tenure FD combines capital safety with predictable returns, making it suitable for those who do not want long lock-in periods.

Complete Information Table: Canara Bank 310 Day FD 2026

| Feature | Details |

|---|---|

| Bank Name | Canara Bank |

| Deposit Type | Fixed Deposit (Special Tenure) |

| Tenure | 310 Days |

| Risk Level | Low |

| Capital Safety | Backed by Public Sector Bank |

| Interest Rate | As per prevailing 2026 bank rates |

| Senior Citizen Benefit | Higher rate as per policy |

| Payout Option | At maturity or periodic interest |

| Premature Withdrawal | Allowed with penalty |

| Mode of Opening | Branch visit, Net Banking, Mobile Banking |

| Suitable For | Salaried individuals, retirees, business owners |

| Investment Purpose | Short term fund parking |

Understanding the 310 Day Fixed Deposit Plan

The 310 day FD is a special maturity scheme introduced for customers who want to invest for less than one year while still earning better returns than a regular savings account. Unlike a traditional 12 month fixed deposit, this plan matures slightly earlier, offering flexibility in financial planning. The structure follows standard FD rules where the interest rate is locked at the time of booking and remains unchanged throughout the tenure. Investors deposit a lump sum amount for 310 days and receive the principal along with interest at maturity, unless they choose periodic payout options.

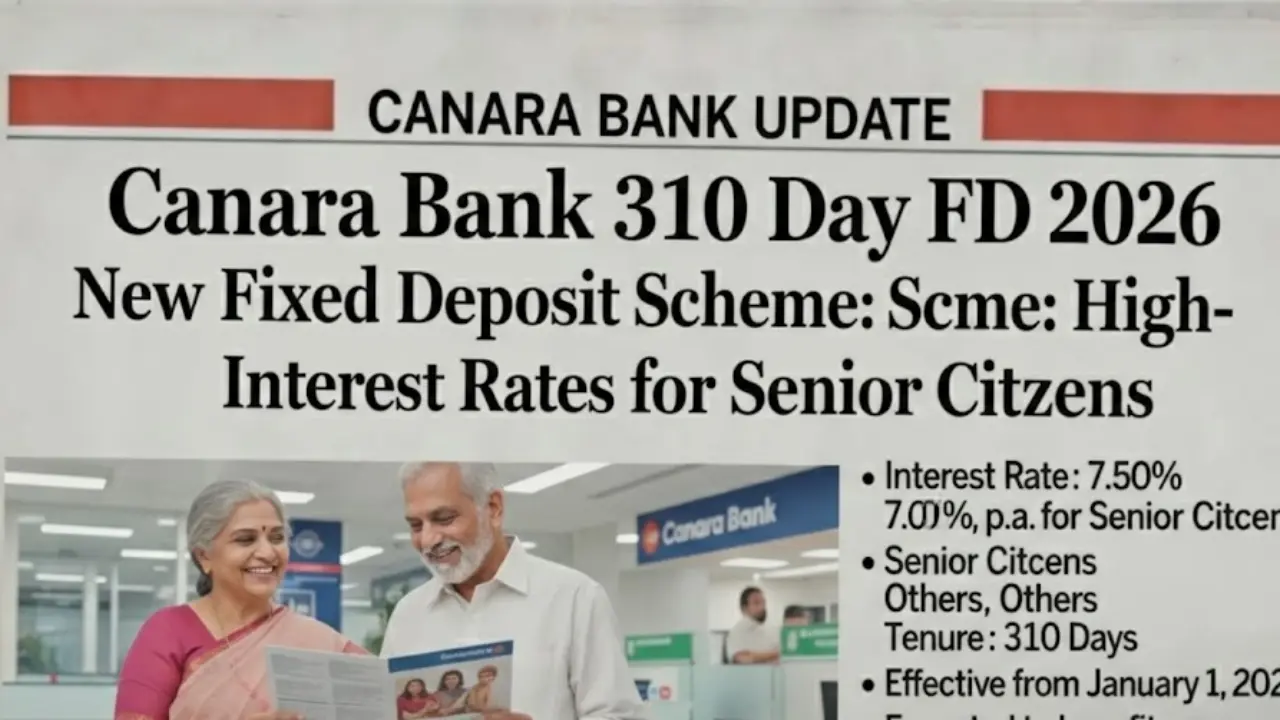

Interest Rates and Expected Returns in 2026

Interest rates for the 310 day FD depend on the bank’s prevailing deposit structure in 2026. Regular customers receive a fixed rate as declared at the time of investment, while senior citizens generally receive a slightly higher rate as per bank policy. Once the deposit is created, the return remains fixed for the entire tenure, protecting investors from market fluctuations. The interest can typically be taken at maturity or paid periodically depending on the selected option. Since rates may change over time, investors are advised to verify the latest official figures before booking the deposit.

Why This Short-Term FD Is Gaining Popularity

Short duration deposits are trending in 2026 because they provide stability without long commitments. The 310 day FD appeals to investors who want guaranteed returns with minimal risk exposure. Being backed by a public sector institution, it offers a sense of security regarding capital safety. The tenure is ideal for individuals waiting for future expenses, business payments, property purchases, or reinvestment opportunities. Instead of keeping idle funds in low interest savings accounts, many prefer locking them into this fixed deposit for better earnings within a limited time frame.

Who Can Benefit from the 310 Day FD

This investment option is suitable for salaried professionals who receive bonuses, retirees managing pension funds, and small business owners holding temporary surplus capital. It is also appropriate for conservative investors who prioritize safety over high risk returns. Senior citizens, in particular, may find the slightly higher interest rate beneficial for short term income planning. Additionally, those who expect to need funds within a year may consider this tenure more convenient than longer fixed deposits.

How to Open the 310 Day Fixed Deposit

Opening a 310 day FD is simple and convenient. Existing customers of Canara Bank can use internet banking or mobile banking services to create the deposit instantly. New customers may visit the nearest branch with valid KYC documents such as identity proof, address proof, and PAN details. The minimum deposit amount is determined by bank guidelines, and customers can choose the maturity payout option at the time of booking. Once confirmed, the FD receipt is generated either digitally or physically depending on the mode of application.

Important Factors to Consider Before Investing

While fixed deposits are considered safe, investors should keep certain points in mind. Premature withdrawal may attract penalties, which can reduce the effective return. Therefore, it is important to invest only surplus funds that are not required urgently. Comparing interest rates with other banks or short term financial instruments can help ensure better decision making. Reviewing the effective annual yield also gives a clearer understanding of actual earnings over 310 days. Proper planning ensures that the FD aligns with short term financial goals.

Final Thoughts

The Canara Bank 310 Day FD 2026 stands out as a dependable short term investment for individuals who value capital protection and steady returns. Its slightly shorter than one year tenure provides flexibility while still offering competitive interest compared to regular savings accounts. For investors seeking stability during uncertain market conditions, this scheme offers a balanced combination of safety, simplicity, and predictable earnings. Before investing, always check the latest official interest rates and terms to ensure the deposit fits your financial plan.